F5 Capital Debt Fund 1

F5 Capital Debt Fund was created to offer accredited investors the ability to passively invest in real estate lending. All investments are secured by real estate and personally guaranteed by the borrower.

7% to 9% Preferred Return*

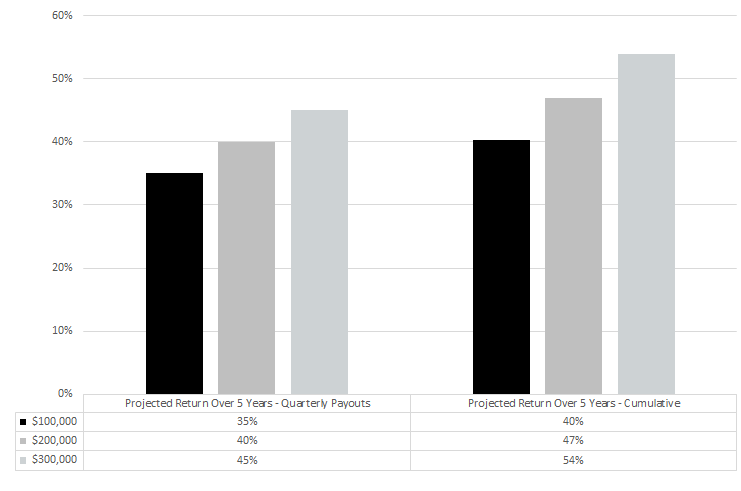

9% Preferred Returns for investments equal to or greater than $300,000 8% Preferred Returns for investments between $200,000 and $299,000 7% Preferred Returns for investments less than $199,000

Flexibility

Flexible payout terms allowing investors to take quarterly payouts or reinvest proceeds. Investors can choose to have capital returned from the fund anytime after the first year of investment.

Low Minimum Investment

The best way to talk to an investor about our products is to meet them face to face at local and online meetups.

Projected Returns

What We Do

This investment fund is built around the success of F5 Capital Group in the private lending space specifically for real estate investors. F5 Capital has funded over 230 loans by forming relationships with some of the top real estate investors in the Metro Detroit Area

This investment fund will lend money to real estate investors looking to purchase and update real estate to be sold or held as rentals. Investments are screened based on the value of the loan to final value, investor experience, location, and other factors.

This fund will leverage F5 Capital’s experience, business model, clients, and relationships to successfully lend funds to real estate investors.

Why Us

Short Term Investments

Investments in the fund will be for shorter terms, which gives the manager flexibility to more accurately predict market moves.

Investor Liquidity

Short term investments allow managers to offer shorter investment term of 1 year minimum compared to an apartment fund or government bond which can last 5 years or more.

Diversified Platform

Investing in the fund allows investor funds to be diversified across many client loans reducing risk & potential of loss to the investor

Protected Downside

Loans provided to clients of the fund are provided at 75% of loan to ARV. Some loans will also require minimum DSCR thresholds if they are held as a rental.

FAQ

The minimum investment amount is $50,000.00

The minimum investment timeframe is 1 year

Yes, you can invest certain types of retirement accounts into the fund. We can walk you through the process it’s very easy!

Adam has over 10 years of real estate experience and 6 years in lending.

The fund lends money to investors who purchase and rehab homes or apartments. All money lent out to investors is backed by a mortgage and first lien position on the property.

About Us

Adam has a Bachelor’s Degree in Mechanical Engineering and spent 12 years in the automotive industry in several roles including Vice President of Engineering, Sales and Purchasing. In 2008 he started his own manufacturing business focusing on plastic components for the automotive industry and managing an industrial building portfolio. In 2010 Adam sold his automotive business and in 2012 left the auto industry to focus on real estate full time.

In 2013 he purchased his first multi family building, a 48-unit residential property. In the last ten years Adam has added to his real estate portfolio through direct purchases, strategic partnerships and syndications and currently has $30,000,000 of real estate assets under management.

In 2017, Adam started F5 Capital Group to focus on short term lending to real estate investors. Since its first loan in 2017, F5 Capital Group has funded over 230 properties for real estate investors in the Metro Detroit area. F5 Capital currently averages 5 funded deals every month.

Adam is married to Jennifer and they have three daughters, Julia, Lyla, and Bella.

SCHEDULE FREE INVESTOR DISCOVERY CALL

General Disclaimer

If you are not the intended recipient of this message, you are hereby notified that any review, dissemination, distribution or copying of this message is strictly prohibited.

No information provided on this Investor Packet, email, or other communication shall constitute an offer to sell or a solicitation of an offer to invest In any securities or ownership interests in real estate opportunities that are sponsored by, managed by, or otherwise affiliated with F5 Capital Group LLC, and its affiliates (collectively, the “Company”).

This communication, email, investor packet, or other communication does not constitute an offer to sell or buy any securities, units, shares, or ownership interests (“Securities”).

There shall be no offer or sale of the Securities to more than thirty-five (35) non-accredited, but sophisticated investors as defined by Rule 501 of the Securities Act of 1933, as amended (the “1933 Act”), unless an exempt offering.

There are no caps to the amount of accredited investors unless specified otherwise in the 1933 Act. No communication herein should be construed as a recommendation for any security offering.

Neither the Company nor its affiliates is a registered investment adviser or registered under the Investment Company Act of 1940. Prospective investors should not construe the contents of communication as legal, tax, investment, or other advice.

All prospective investors are strongly advised to consult with their tax, legal and financial advisors. This Investor Deck contains privileged and confidential information and unauthorized use of this information in any manner is strictly prohibited.

If you are not the intended recipient, please notify the sender immediately. This Investment Deck is for informational purposes and is not intended to be a general solicitation or a securities offering of any kind.

The information contained herein is from sources believed to be reliable, however, no representation by Sponsor(s), either expressed or implied, is made as to the accuracy of any information on this property and all investors should conduct their own research to determine the accuracy of any statements made.

An investment in this offering will be a speculative investment and subject to significant risks and therefore investors are encouraged to consult with their personal legal and tax advisors. Neither the Sponsor(s), nor their representatives, officers, employees, affiliates, sub-contractor or vendors provide tax, legal or investment advice. Nothing in this document is intended to be or should be construed as such advice.

The SEC has not passed upon the merits of or given Its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials.

However, pr1or to making any decision to contribute capital, all Investors must review and execute the Private Placement Memorandum and/or related offering documents.

The securities are subject to legal restrictions on transfer and resale and Investors should not assume they will be able to resell their securities Potential Investors and other readers are also cautioned that these forward-looking statements are predictions only based on current Information, assumptions and expectations that are Inherently subject to risks and uncertainties that could cause future events or results to differ materially from those set forth or Implied by such forward looking statements.

These forward-looking statements can be Identified by the use of forward-looking terminology, such as “may,” “will”, “seek”, “should,” “expect,” “anticipate”, “project,” “estimate,” “intend,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology.

These forward-looking statements are only made as of the date of this executive summary and Sponsors undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

This Investment Deck further contains several future financial projections and forecasts. These estimated projections are based on numerous assumptions and hypothetical scenarios and Sponsor(s) explicitly make no representation or warranty of any kind with respect to any financial projection or forecast delivered In connection with the Offering or any of the assumptions underlying them.

This Investment Deck further contains performance data that represents past performances. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data presented.

All return examples provided are based on assumptions and expectations considering currently available information, and industry trends.

Therefore, actual performance may substantially differ from these projections and no guarantee is presented or implied as to the accuracy of specific forecasts, projections, or predictive statements contained in this Investment Deck.

The Sponsor further makes no representations or warranties that any investor will, or is likely to achieve profits similar to those shown in the pro-formas or other financial projections.